2026 Digital Marketing Trends: Expert Predictions for Paid Media & Ecommerce

Every January, the digital marketing world floods with predictions: some insightful, many recycled, and a few wildly off base. But 2026 feels different. We're not just watching incremental platform updates or minor algorithm tweaks anymore. We're witnessing fundamental shifts in 2026 marketing trends: how consumers discover products, how platforms deliver ads, and how marketers prove their work actually matters. The gap between brands that adapt and those that cling to old playbooks is about to become a chasm.

So we asked our team at Revel Marketing Partners where they think the industry is headed this year. What follows isn't speculation from the sidelines. These are predictions from the directors and leaders who are already navigating these changes with our clients, and who have strong opinions about what's coming next.

Revel Marketing Partners’ 2026 Digital Marketing Predictions

AI and Headless Commerce Are Reshaping the Shopping Experience

Kayla Faires, Founder & CEO:

"The future of digital marketing is about rebuilding infrastructure so you can move as fast as the platforms change. Two shifts are converging: headless ecommerce architectures, and agentic search systems where AI answers questions and makes recommendations before consumers reach your brand. Creative velocity and experimentation speed now determine ROAS, and legacy platforms are making it harder and harder to deliver. At the same time, discovery is shifting from queries to AI-mediated recommendations. Brands will compete less on keyword ownership and more on structured, machine-readable truth: clean product data, pricing logic, availability, and positioning that agents can interpret and recommend. As automation increases, judgment becomes the differentiator. The winners will pair flexible infrastructure with authentic brand building. Brands that actually stand for something and show their authenticity, while also leaning into new tech will compound advantages while others optimize yesterday's funnel."

Michele Keating, Account Director:

"Short-form video, AR try-ons, and creator demos won't just support ecommerce—they'll replace traditional PDPs. Live shopping will become the default, and UGC becomes the most trusted conversion asset."

AI-Powered Search and the End of Traditional Search Behavior

Abby Peterson, Director of SEM:

"2026 will mark the inflection point for paid search as AI advertising platforms fundamentally compress the user research journey. What once took 10+ searches now happens in a single ChatGPT conversation. Google Paid Search will remain a revenue powerhouse, but declining traffic volumes and intensifying CPCs will force a strategic reckoning: we can no longer afford to bid broadly. Success in this new landscape belongs to marketers who get ruthlessly selective with keyword targeting, double down on high-intent bottom-funnel terms, and maximize every click with precision audience strategies. The brands that will win aren't fighting this shift, they're adapting their strategies across both ecosystems while search is still profitable."

Brandon Elston, Paid Media Specialist:

"Brands that invest in GEO to appear in LLMs like ChatGPT & Gemini, will finally see a noticeable impact on purchases, especially from new customers. With the introduction of Universal Commerce Protocol (UCP) and direct integration of ChatGPT to Shopify, it is becoming increasingly more beneficial for consumers to shop on LLMs compared to search engines. This is because users can shop products across brands and make a purchase all in one ecosystem without browsing dozens of sites for inventory, products, or to find the best deals. A survey from Centerfield last year showed that the top 3 reasons users shop with AI are getting answers to product questions, comparing products or brands, & getting product recommendations, all top of funnel discovery type searches that could lead to discovering new brands and products."

Raw Creativity and Authenticity Will Beat AI Perfection in 2026

Paige Baugnet, VP of Client Services:

"I predict that we'll continue to see authentically raw and unpolished creative perform exceptionally well in 2026 as a direct counter to AI-generated perfection, particularly as consumers become increasingly skeptical about distinguishing real from fake content. In a digital landscape saturated with polished, algorithm-optimized visuals that all start to look eerily similar, people will actively crave authenticity and realness—the imperfect lighting, the shaky camera work, the unfiltered moments that signal genuine human creation. Brands that lean into this 'intentionally unpolished' aesthetic beyond the existing creator playbook will likely see stronger engagement and trust metrics, as audiences reward the vulnerability and transparency that comes with content that feels unmistakably human."

Jessica Shepherd, Chief Operating Officer:

"In 2026, the digital marketing industry will feel the real disruption not through job loss, but through the loss of excuses for mediocre thinking. As AI makes execution cheap, taste becomes a true competitive advantage—especially for beauty, fashion, and lifestyle brands where differentiation lives in nuance, not volume. The biggest brand risk won't be getting AI wrong; it will be sounding like everyone else who got it 'right.' That's why human review will increasingly serve as the new quality assurance layer—not to slow creativity down, but to protect brand distinctiveness in an automated world."

Marketing Mix Modeling, Diversification and the Shift to Incrementality

Amanda Moorhead, Account Director:

"2026 is going to be all about incrementality and accurate measurement for marketing. Last-click attribution isn't telling enough of the story, privacy changes are throwing a wrench into reporting, and relying on the same old methods is going to bring lackluster results. The brands that will unlock growth are those who can answer one critical question: 'What actually moved the needle?' That's why I'm excited to work with my clients on implementing MMM tools and diversifying their media mix. The future isn't about which touchpoint gets credit—it's about proving which dollars are truly incremental."

Gretta Schultz, Director of Paid Social:

"2026 is the year digital marketing finally gets its "infrastructure" right - better measurement, smarter and more consistent/reliable automation, and creative journeys that prioritize sustainable growth over quick wins."

Ashley Simpson, Director of Affiliate Marketing:

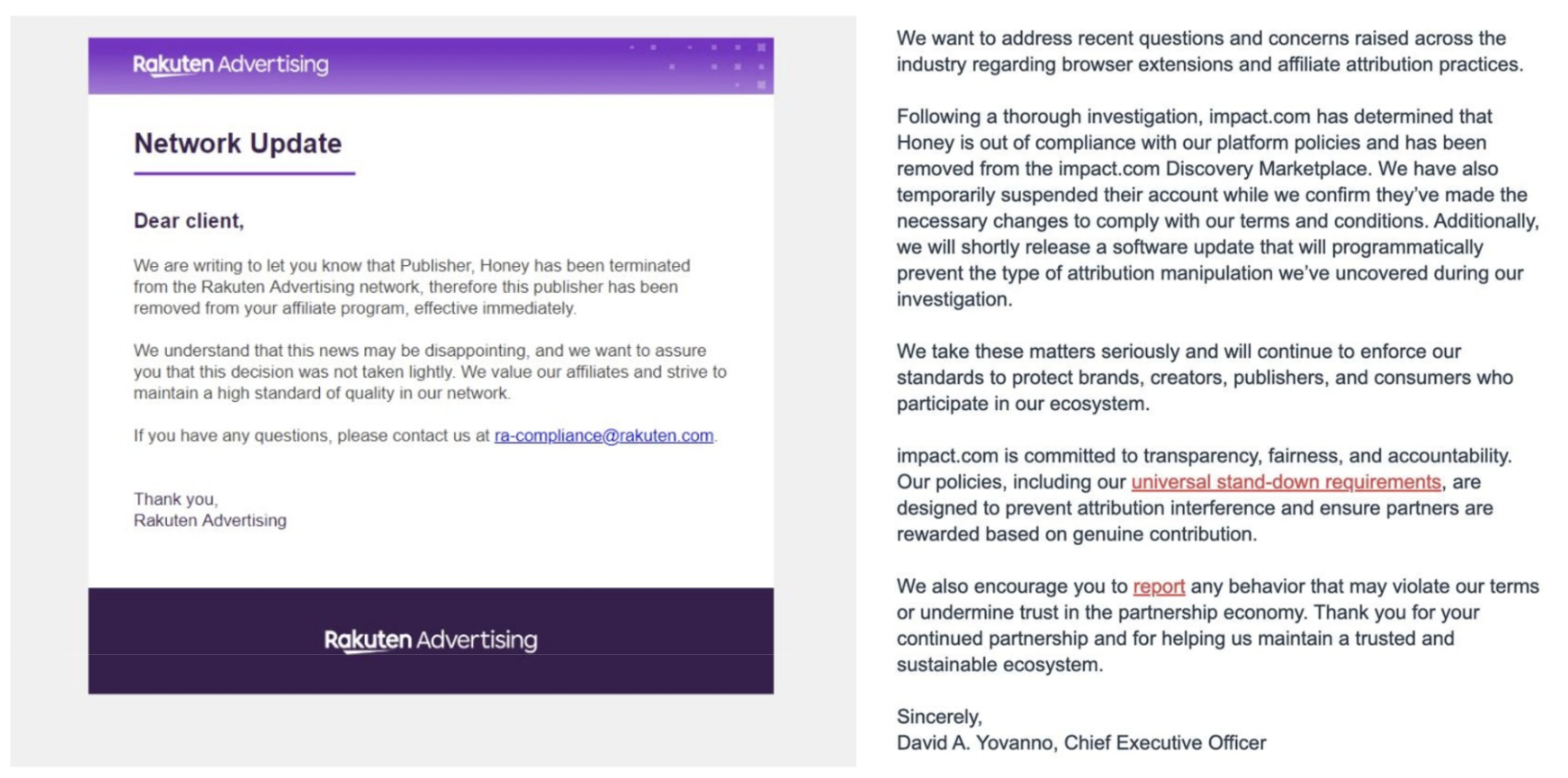

"We predict affiliate programs will prioritize channel diversification and robust partner vetting following high-profile removals like PayPal Honey, while navigating increased FTC enforcement under the Consumer Review Rule that rewards proactive compliance. We expect the industry to accelerate its shift from last-click attribution toward outcome-based models that credit partnership contributions, as both affiliate and creator marketing mature with greater emphasis on measurable ROI over vanity metrics. Affiliate publishers will continue expanding beyond Google Search dependence through multi-channel strategies spanning social platforms, direct traffic, and emerging opportunities like OpenAI's ChatGPT ads. Meanwhile, long-term creator partnerships will become the standard as brands recognize the value of sustained relationships, with emerging content formats and technologies requiring affiliate programs to evolve their partnership structures and compensation models accordingly."

What This Means for Your 2026 Strategy

The through-line in all of these predictions? 2026 rewards the strategic over the reactive. Whether it's demanding proof of incrementality, embracing rough authenticity over AI polish, adapting to compressed search journeys, optimizing for AI-powered discovery, or protecting brand voice in an automated world, the brands that will thrive are those willing to challenge their assumptions and evolve their approach. The tools are getting smarter, the platforms are getting more automated, and the consumer is getting more discerning. Your strategy needs to keep pace. At Revel Marketing Partners, we're not just watching these shifts happen. We're actively helping our clients navigate them. If any of these predictions hit home and you're wondering how to adapt your own marketing strategy, let's talk. Because the future isn't something that happens to you. It's something you build toward, one smart decision at a time.